Subsidy is an amount provided by manufacturer or a dealer to the lessor to increase the margin on the deals. Subsidies provided on a lease by a manufacturer or Dealer either supplement lessor’s income or adjust the rate charged to the lessee. The benefits include lessor providing flexible finance arrangements to meet manufacturer’s needs. OLFM Provides the functionality for the following two kinds of subsidy:

- Discount Subsidy

- Rate Subsidy

Discount Subsidy

Discount subsidy is the amount provided by the dealer or manufacturer to lessor to reduce the acquisition cost of the equipment for the lessor. This amount may not be known to the lessee.

Rate Subsidy

A rate subsidy is the adjustment of the interest rate on the lease deal provided by the lessor to lessee. This amount is in turned billed by the lessor to the manufacturer or dealer. This is an income for the lessor and is amortized over the period of the contract.

Benefits of subsidy

- Subsidy helps lessor get more business because lessee gets discount or rate reduction on the lease and thus they will be more inclined to go for the lease deal

- Subsidies can be targeted to a specific group of industry, equipment items or special organizations.

- Manufacturers do not have to reduce the price of the equipment explicitly; this will help reduce the negative impact of price reduction

Setups for Subsidy

Before subsidy can be used with a contract, it has to be setup. We can setup the following subsidy features:

Subsidy Pools

Subsidy pools are created to manage and control the total subsidy amount. The pool helps lessor ensure that total amount of the subsidy given on different deals does not exceed the approved budget specified by dealer/manufacturer. Subsidy pools contain different kind of subsidies. Whenever a contract is authored with subsidy, the subsidy pool associated with that subsidy is updated to reflect the remaining balance available. Subsidy pools can be created by the following navigation.

Lease Super User => Marketing => Pricing Programs => Subsidy Pools

Subsidies

The subsidy can be created using the following navigation: Lease Super User => Pricing Programs => Subsidies Various fields on the screen are described below:

| Field Name | Description |

| Operating Unit | Defaulted automatically from current operating unit. |

| Name | Name of the subsidy |

| Description | Description of the subsidy |

| Long Description | Long description |

| Vendor | Vendor (Dealer/Manufacturer) who is providing the subsidy |

| Subsidy Pool | Subsidy pool to which this subsidy is to be associated |

| Subsidy Pool Status | Status of the subsidy pool. Automatically displayed |

| Application | |

| Currency | Currency of the subsidy |

| Available on Release | Will the subsidy be available when asset is getting released |

| Effective From | Effective start date of subsidy. Only contracts having start date greater than or equal to this date will be eligible for this subsidy. |

| Maximum Term | Maximum term of the contract for being eligible to have the subsidy. |

| Effective To | Effective end date of the subsidy |

| Expire After Days | Subsidy will expire after these many days |

| Exclusive | Yes/No |

| Calculation | |

| Basis | Calculation of subsidy can be done the basis of Asset Cost, Financed Amount, Fixed Amount, Formula or Rate Points. Based on what you select, the other corresponding fields are enabled.

Asset Cost: If asset cost is chosen as basis, then percentage has to be entered in next field. If asset cost is 10,000 and percentage entered is 10%, then subsidy will be 1,000. Financed Amount: if this option is chosen, Subsidy amount will be calculated based on financed amount. Fixed Amount: You can enter a fixed amount for subsidy Formula: You can enter a formula to derive the subsidy amount Rate Points: Rate point to be used for Rate subsidy. E.g. you can enter 0.45 to give a discount of 0.45 percent on the interest rate. |

| Percent | This field will be available for entry if asset cost or financed amount is chosen in the Basis Field. |

| Maximum Financed Amount | Maximum amount that can be financed under this subsidy scheme. |

| Maximum Subsidy Amount | Maximum amount of subsidy that can be given on a contract. If the calculated subsidy is greater than maximum subsidy amount, then subsidy amount is reset to maximum subsidy amount. |

| Processing | |

| Stream Type | Custom Stream type used for accounting of subsidy. This stream type should be defined under pricing tab with purpose of ‘ Subsidy’ |

| Accounting Method | |

| Net on Funding | |

| Visible to Customer | If Yes is chosen, the subsidy amount will be visible to customers on Customer Self Service application. |

| Termination | |

| Recourse | Recourse means when contract is terminated prior to the expiry date, does the lessor have to pay the subsidy amount back to the vendor? You can choose Yes or No here. If Yes, is chosen, it will display Refund Basis field.Refund Basis: All, FormulaAll means full subsidy has to be refunded. You can also choose a formula to derive the recourse amount. |

| Transfer Basis | The values can be Accelerate or Refund. When accelerate is chosen, the remaining subsidy income is accelerated for accrual. When refund is chosen, the amount is refunded to the subsidy provider. |

Association with the Contract

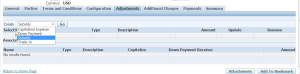

Once subsidy is defined and associated with a subsidy pool and the subsidy pool is activated, it is available for associating with a contract. The subsidy is attached during contract authoring process. Subsidy is created under adjustment tab of the authoring screens.

After choosing subsidy, we need to add the assets with the subsidy. We also need to choose the party (vendor who is providing the subsidy). On saving the subsidy amount is automatically derived based on the subsidy setup.